Inmarsat - Modelling a Possible Takeover

22 March 2019

Renewed interest in Inmarsat prompts investors to consider the takeover valuation in the Convertible

The announcement earlier this week that Inmarsat has received a proposal for a cash offer of US$7.21 per share has focused eyes once again on the impact such a possible takeover would have on the valuation of the company’s 3.875% Sep-2023 convertible bonds.

The terms of the Inmarsat convertible bonds provide for a more unusual takeover protection clause, one designed effectively to compensate holders for the prevailing conversion premium. In the event of a Change of Control, an adjusted Change of Control Conversion Price would be calculated using a 15-day average traded conversion premium for the Calculation Period ending 5 days prior to the offer Commencement Date.

Our reading of the prospectus is that the company’s announcement of the possible offer on 19-Mar-2019 has set the Commencement Date (19-Mar), and therefore the Calculation Period (22-Feb to 14-Mar inclusive) applicable in calculating a Change of Control Conversion Price, should a Change of Control result. Should any subsequent counter offer or revision be made within 90 days of the end of the current offer period, we understand that the Commencement Date would remain 19-Mar-2019.

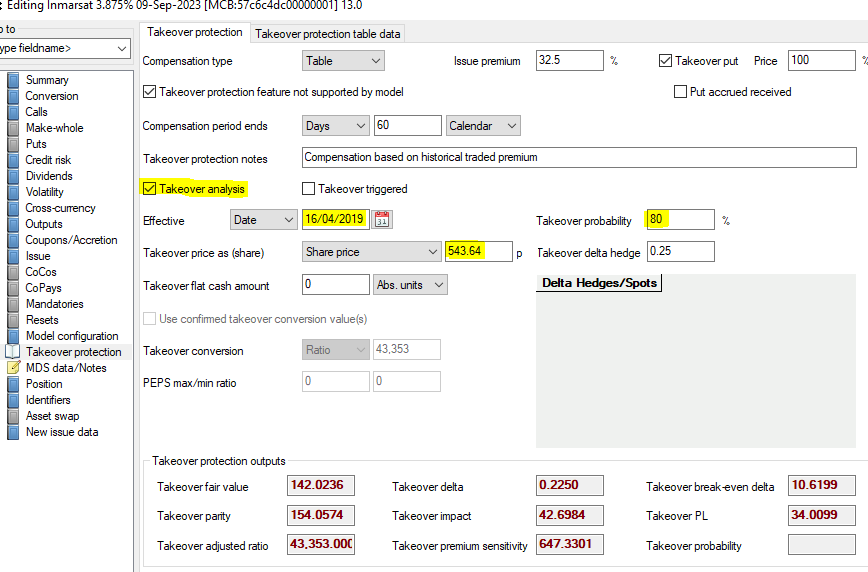

Based on our calculations, we estimate an adjusted Change of Control Conversion Price of $4.6132, giving an adjusted ratio of approx. 43,353 shares per bond. At the cash offer price of US$7.21, this gives a takeover conversion value of approx. 154% of par.

Modelling a takeover scenario in Monis

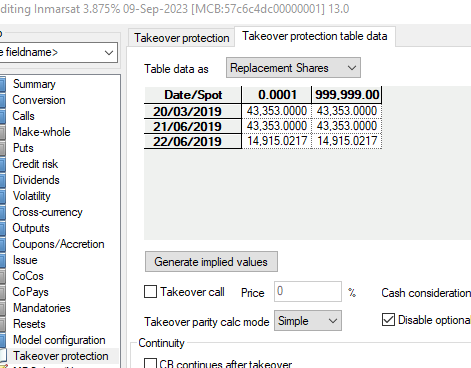

In the case of Inmarsat, we have added data to the takeover make-whole shares table in Monis to allow users to easily model the potential impact, should a change of control event result from the current situation.

After enabling the Takeover Analysis section, users can enter their own assumptions for the the expected effective date (either a specific date or a number of months in the future), the takeover offer price for the underlying shares (either an absolute share currency price or at some premium to the current, or forward, spot price) and the probability of an event happening.

Contact us

If you would like to discuss this, or any other aspect of Monis or the Data Service, please feel free to contact us at Monis support.

philip.kramer@fisglobal.com

tatyana.hube@fisglobal.com

william.weichhart@fisglobal.com

monis.data@fisglobal.com

Copyright © 2019 by Fidelity National Information Services, Inc. and/or its subsidiaries ("FIS"). This document is copyrighted with all rights reserved. No part of this document may be reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of FIS. Except as set out in the contract your company has with FIS, in no event shall FIS be liable for damages of any kind arising out of the use of this document.