Suzuki 0% 2021 and 2023

7 March 2016

Suzuki payoff - variable conversion

We've received a number of questions on the structure of the new Suzuki convertible bonds; they contain an interesting net share settlement feature that impacts their payoff profile.

On conversion, holders will receive 100% of the principal amount in cash, together with a number of Exercise Acquisition Shares representing the amount that parity exceeds the principal amount. However, the number of shares that would be received is capped at the Maximum Exercise Acquisition Shares, equal to the principal amount divided by 2x the conversion price.

In effect, we believe holders should view the conversion payoff as analogous to being able to convert into only half the conversion ratio for stock prices at and above 200% of the conversion price. Alternatively, the structure could be thought of as being long the Conversion Ratio number of calls at a strike of the Conversion Price and short half the Conversion Ratio number of calls at a strike of 2x the conversion price. We illustrate below how the conversion value varies with the underlying share price.

Modelling in the Monis Data Service

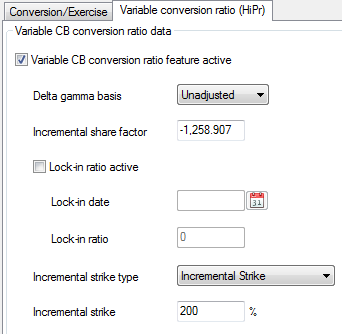

In MDS we have setup these convertibles making use of the Variable Conversion feature, available under the conversion tab. We specify an incremental strike of 200%, the level above which the conversion ratio is to be varied, and we enter an incremental share factor equal to negative half the conversion ratio, representing the cap on the number of shares received.

Given the secondary strike, some clients may wish to make use of the dual volatility model (in v13) and specify two different volatility assumptions or, alternatively use the volatility surface feature in Monis in order to allow some differentiation between the volatility assumptions at the two strikes.

Contact us

If you would like to discuss this, or any other aspect of the Monis Data Service, please feel free to contact us at Monis support.

philip.kramer@fisglobal.com

tatyana.hube@fisglobal.com

william.weichhart@fisglobal.com

monis.data@fisglobal.com

Copyright © 2016 by Fidelity National Information Services, Inc. and/or its subsidiaries ("FIS"). This document is copyrighted with all rights reserved. No part of this document may be reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of FIS. Except as set out in the contract your company has with FIS, in no event shall FIS be liable for damages of any kind arising out of the use of this document.